Australian Capital Territory Numbered Acts

Australian Capital Territory Numbered Acts Australian Capital Territory Numbered Acts

Australian Capital Territory Numbered Actsin part 2, insert

8AA Post-1 October 2013 lease—land rent payable

(1) This section applies to a land rent lease first granted under a contract entered into on or after 1 October 2013.

(2) The land rent payable for the land rent lease for the year the lease is first granted is the discount percentage of the unimproved value of the parcel of land under the lease.

Note Land rent is payable to the commissioner (see s 19).

(3) The land rent payable for the land rent lease for a year after the year the lease is first granted is the lesser of—

(a) the discount percentage of the unimproved value of the parcel of land under the lease; and

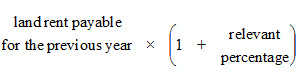

(b) the amount worked out as follows:

(4) In this section:

"land rent payable for the previous year "means the land rent that would have been payable for the lease if it had been a land rent lease, leased to the lessee, for the whole of the previous year.

"unimproved value", of a parcel of land under a land rent lease for a year, means the unimproved value—

(a) for subsection (2)—determined under the Rates Act 2004

, section 9 (First determination of unimproved value) for the year; and

(b) for subsection (3)—determined under the Rates Act 2004

, section 10 (1) (Annual redeterminations) for the year.