Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Schemes to reduce income tax

Income Tax Assessment Act 1936

1 Sub section 1 77A(1)

Insert:

"non-refundable R&D tax offset" means a tax offset allowed under Division 355 of the Income Tax Assessment Act 1997 , other than a refundable R&D tax offset.

"refundable R&D tax offset" means a tax offset allowed under Division 355 of the Income Tax Assessment Act 1997 that is subject to the refundable tax offset rules under section 67 - 30 of that Act.

2 After paragraph 177C(1)(bc)

Insert:

or (bd) a refundable R&D tax offset, or a non - refundable R&D tax offset, being allowable to the taxpayer in relation to a year of income where the whole or a part of the offset would not have been allowable, or might reasonably be expected not to have been allowable, to the taxpayer in relation to that year of income if the scheme had not been entered into or carried out;

3 At the end of sub section 1 77C(1)

Add:

; and (h) in a case to which paragraph ( bd) applies--the amount of the whole of the offset or of the part of the offset, as the case may be, referred to in that paragraph.

4 At the end of sub section 1 77C(2)

Add:

; or (f) a refundable R&D tax offset, or a non - refundable R&D tax offset, being allowable to the taxpayer in relation to a year of income the whole or a part of which offset would not have been, or might reasonably be expected not to have been, allowable to the taxpayer in relation to that year of income if the scheme had not been entered into or carried out, where:

(i) the allowance of the offset to the taxpayer is attributable to the making of a declaration, agreement, election, selection or choice, the giving of a notice or the exercise of an option by any person, being a declaration, agreement, election, selection, choice, notice or option expressly provided for by this Act; and

(ii) the scheme was not entered into or carried out by any person for the purpose of creating any circumstance or state of affairs the existence of which is necessary to enable the declaration, agreement, election, selection, choice, notice or option to be made, given or exercised, as the case may be.

5 Sub section 1 77C(3)

Omit "or (e)(i)", substitute ", (e)(i) or (f)(i)".

6 After paragraph 177C(3)(cb)

Insert:

or (cc) the allowance of a refundable R&D tax offset, or a non - refundable R&D tax offset, to a taxpayer;

7 At the end of sub section 1 77C(3)

Add:

; or (i) the refundable R&D tax offset, or non - refundable R&D tax offset, would not have been allowable.

8 At the end of sub section 1 77CB(1)

Add:

; (f) the whole or a part of a refundable R&D tax offset, or of a non - refundable tax offset, not being allowable to the taxpayer.

9 After paragraph 177F(1)(e)

Insert:

or (f) in the case of a tax benefit that is referable to:

(i) a refundable R&D tax offset; or

(ii) a non - refundable R&D tax offset; or

(iii) a part of a refundable R&D tax offset; or

(iv) a part of a non - refundable R&D tax offset;

being allowable to the taxpayer in relation to a year of income--determine that the whole or a part of the offset, or the part of the offset, as the case may be, is not to be allowable to the taxpayer in relation to that year of income;

10 After paragraph 177F(3)(f)

Insert:

or (g) if, in the opinion of the Commissioner:

(i) an amount would have been allowed, or would be allowable, to the relevant taxpayer as a refundable R&D tax offset, or a non - refundable R&D tax offset, in relation to a year of income if the scheme had not been entered into or carried out, being an amount that was not allowed or would not, apart from this subsection, be allowable, as the case may be, as a refundable R&D tax offset, or a non - refundable R&D tax offset, as the case may be, to the relevant taxpayer in relation to that year of income; and

(ii) it is fair and reasonable that the amount, or a part of the amount, should be allowable as a refundable R&D tax offset, or a non - refundable R&D tax offset, as the case may be, to the relevant taxpayer;

determine that that amount or that part, as the case may be, should have been allowed or is allowable, as the case may be, as a refundable R&D tax offset, or a non - refundable R&D tax offset, as the case may be, to the relevant taxpayer in relation to that year of income;

Part 2 -- R&D clawback and catch up amounts

Income Tax Assessment Act 1997

11 Section 4 - 25

Repeal the section, substitute:

4 - 25 Special provisions for working out your basic income tax liability

Subsection 392 - 35(3) may increase your basic income tax liability beyond the liability worked out simply by applying the income tax rates to your taxable income.

Note: Subsection 392 - 35(3) increases some primary producers' tax liability by requiring them to pay extra income tax on their averaging components worked out under Subdivision 392 - C.

12 Subsection 9 - 5(1) (table item 4A)

Repeal the item.

13 Section 1 0 - 5 (table item headed "R&D")

Omit:

feedstock adjustment ........................ | 355 - 465 |

substitute:

recoupments and feedstock adjustments ........... | 355 - 450 |

14 Section 20 - 5 (table item 1 0)

Repeal the item, substitute:

10 | An R&D entity: • receives, or becomes entitled to receive, a recoupment from government relating to R&D activities; or • can deduct, under Division 355, expenditure on goods, materials or energy used during R&D activities to produce marketable products or products applied to the R&D entity's own use; and the entity is entitled under Division 355 to a tax offset relating to those R&D activities. An amount is included in its assessable income. | Subdivision 355 - G |

15 Sub section 4 0 - 292(1)

Omit "Note", substitute "Note 1".

16 At the end of subsection 4 0 - 292(1)

Add:

Note 2: To the extent that any amount is included in your assessable income under section 4 0 - 285 in relation to R&D activities, you may have an additional amount included in your assessable income (see section 355 - 447).

Note 3: To the extent any amount that you are entitled to as a deduction under section 4 0 - 285 relates to R&D activities, you may have an additional amount you can deduct (see section 355 - 466).

17 Subsections 40 - 292(3) to (5)

Repeal the subsections.

18 Sub section 4 0 - 293(1)

Omit "Note", substitute "Note 1".

19 At the end of subsection 4 0 - 293(1)

Add:

Note 2: To the extent any amount that is included in the R&D partnership's assessable income under section 4 0 - 285 relates to R&D activities, a partner may have an additional amount included in the partner's assessable income (see section 355 - 449).

Note 3: To the extent any amount that the R&D partnership is entitled to as a deduction under section 4 0 - 285 relates to R&D activities, a partner may have an additional amount the partner can deduct (see section 355 - 468).

20 Sub section 4 0 - 293(3)

Repeal the subsection.

21 Paragraphs 355 - 100(1)(c) and (f)

Repeal the paragraphs.

22 Section 355 - 105

Before "An amount", insert "(1)".

23 At the end of section 355 - 105

Add:

(2) Subsection (1) does not apply to amounts that the * R&D entity can deduct under the following:

(a) subsection 355 - 315(2);

(b) subsection 355 - 475(1);

(c) subsection 355 - 525(2).

24 Subdivision 355 - E (heading)

After " Notional deductions ", insert " etc. ".

25 Section 355 - 300

Omit "notionally deduct" (second occurring), substitute "actually deduct".

26 Subsection 355 - 315(2) (heading)

Repeal the heading.

27 At the end of subsection 355 - 315(2)

Add:

Note 1: A deduction under this subsection is not a notional deduction (see subsection 355 - 105(2)).

Note 2: A deduction under this subsection results in a catch up amount for the R&D entity (see section 355 - 465).

28 Subsection 355 - 315(3)

Repeal the subsection, substitute:

(3) If an amount would be included in the * R&D entity's assessable income for the event year under subsection 4 0 - 285(1) for the asset and the event if Division 40 applied as described in paragraph ( 1)(e), that amount is included in the R&D entity's assessable income for the event year.

Note: Some or all of the amount included in the R&D entity's assessable income may result in a clawback amount for the R&D entity (see section 355 - 446).

29 Subdivisions 355 - G and 355 - H

Repeal the Subdivisions, substitute:

Subdivision 355 - G -- Clawback of R&D recoupments, feedstock adjustments and balancing adjustments

355 - 430 What this Subdivision is about

An amount is included in an R&D entity's assessable income if:

(a) the R&D entity receives a recoupment from government of expenditure on R&D activities for which it has obtained tax offsets under this Division; or

(b) the R&D entity can deduct under this Division expenditure on goods, materials or energy used during R&D activities to produce marketable products or products applied to the R&D entity's own use; or

(c) a balancing adjustment event happens for an asset held by the R&D entity (or an R&D partnership in which the R&D entity is a partner) for which tax offsets have been obtained under this Division and for which an amount is otherwise included in the R&D entity's (or R&D partnership's) assessable income.

Table of sections

Operative provisions

355 - 435 When this Subdivision applies

355 - 440 R&D recoupments

355 - 445 Feedstock adjustments

355 - 446 Balancing adjustments for assets only used for R&D activities

355 - 447 Balancing adjustments for assets partially used for R&D activities

355 - 448 Balancing adjustments for R&D partnership assets only used for R&D activities

355 - 449 Balancing adjustments for R&D partnership assets partially used for R&D activities

355 - 450 Amount to be included in assessable income

355 - 435 When this Subdivision applies

This Subdivision applies to an * R&D entity for an income year (the present year ) if:

(a) the R&D entity has an amount (a clawback amount ) under section 355 - 440, 355 - 445, 355 - 446, 355 - 447, 355 - 448 or 355 - 449 for the present year; and

(b) the R&D entity has received, or is entitled to receive, a * tax offset under section 355 - 100 for one or more income years (each an offset year ) in relation to that clawback amount.

(1) The * R&D entity has an amount under this section if:

(a) the entity, or another entity mentioned in subsection (5), receives or becomes entitled to receive a * recoupment from either of the following (otherwise than under the * CRC program):

(i) an * Australian government agency;

(ii) an STB (within the meaning of Division 1AB of Part I II of the Income Tax Assessment Act 1936 ); and

(b) the recoupment is received, or the entitlement to receive the recoupment arises, during the present year; and

(c) either:

(i) the recoupment is of expenditure incurred on or in relation to certain activities; or

(ii) the recoupment requires expenditure (the project expenditure ) to have been incurred, or to be incurred, on certain activities.

Note: Paragraph (c) includes expenditure incurred in purchasing a tangible depreciating asset to be used when conducting R&D activities.

(2) The amount is equal to the sum of:

(a) so much of the expenditure referred to in subsection (1) that is deducted under this Division; and

(b) for each asset (if any) for which expenditure referred to in subsection (1) is included in the asset's * cost--each amount (if any) equal to the asset's decline in value that is deducted under this Division;

that is taken into account in working out * tax offsets under section 355 - 100 obtained by the * R&D entity for one or more income years.

Note: Paragraphs (a) and (b) of this subsection refer to amounts notionally deducted under this Division (see section 355 - 105).

Amount is reduced by any repayments of the recoupment

(3) For the purposes of subsection (2), reduce the expenditure referred to in sub paragraph ( 1)(c)(i) by any repayments of the * recoupment during an income year.

Cap on extra income tax if recoupment relates to a project

(4) Despite subsection (2), if the * recoupment is covered by sub paragraph ( 1)(c)(ii), the amount mentioned in subsection (2) for the present year cannot exceed the amount worked out using the following formula:

where:

"net amount of the recoupment" means the total amount of the * recoupment, less any repayments of the recoupment during an income year.

"R&D expenditure" means the amount mentioned in subsection (2), disregarding subsection (3).

Related entities

(5) The other entities for the purposes of paragraph ( 1)(a) are as follows:

(a) an entity * connected with the * R&D entity;

(b) an * affiliate of the R&D entity or an entity of which the R&D entity is an affiliate.

355 - 445 Feedstock adjustments

(1) The * R&D entity has an amount under this section if:

(a) it incurs expenditure in one or more income years in acquiring or producing goods, or materials, (the feedstock inputs ) transformed or processed during * R&D activities in producing one or more tangible products (the feedstock outputs ); and

(b) it obtains under section 355 - 100 * tax offsets for one or more income years (each an offset year ) for deductions under this Division:

(i) for the expenditure; or

(ii) for expenditure it incurs on any energy input directly into the transformation or processing; or

(iii) for the decline in value of assets used in acquiring or producing the feedstock inputs; and

(c) during the present year, a feedstock output, or a transformed feedstock output, (the marketable product ), is:

(i) * supplied by the R&D entity to another entity; or

(ii) applied by the R&D entity to the R&D entity's own use, other than use for the purpose of transforming that product for supply.

(2) The amount is equal to the lesser of:

(a) the * feedstock revenue for the feedstock output; and

(b) so much of the total of the amounts deducted as described in paragraph ( 1)(b) as is reasonably attributable to the production of the feedstock output.

(3) Subsection (2) does not apply to the feedstock output if:

(a) it becomes, or is transformed into, a feedstock input; or

(b) that subsection already applies to the feedstock output because of the application of paragraph ( 1)(c) to:

(i) an earlier time during the present year; or

(ii) an earlier income year.

(4) The feedstock revenue , for the feedstock output, is worked out using the following formula:

where:

"market value of the marketable product" means the marketable product's * market value at the time it is:

(a) * supplied by the * R&D entity to the other entity; or

(b) first applied by the R&D entity to the R&D entity's own use, other than use for the purpose of transforming that product for supply.

(5) This section applies to a * supply or use of the marketable product by:

(a) an entity * connected with the * R&D entity; or

(b) an * affiliate of the R&D entity or an entity of which the R&D entity is an affiliate;

as if it were by the R&D entity.

355 - 446 Balancing adjustments for assets only used for R&D activities

(1) The * R&D entity has an amount under this section if:

(a) a * balancing adjustment event happens in the present year for an asset * held by the R&D entity; and

(b) the R&D entity cannot deduct, for the asset for an income year, an amount under section 4 0 - 25 as that section applies apart from:

(i) this Division; and

(ii) former section 73BC of the Income Tax Assessment Act 1936 ; and

(c) the R&D entity is entitled under section 355 - 100 to * tax offsets for one or more income years for deductions under section 355 - 305 for the asset; and

(d) the R&D entity is registered under section 27A of the Industry Research and Development Act 1986 for one or more * R&D activities for the present year; and

(e) an amount (the section 4 0 - 285 amount ) is included in the R&D entity's assessable income for the present year under subsection 355 - 315(3) for the asset and the balancing adjustment event.

Note 1: This section applies in a modified way if the entity also has deductions for the asset under former section 73BA or 73BH of the Income Tax Assessment Act 1936 (see section 355 - 320 of the Income Tax (Transitional Provisions) Act 1997 ).

Note 2: Section 4 0 - 292 applies if the entity can deduct an amount under section 4 0 - 25, as that section applies apart from this Division and former section 73BC of the Income Tax Assessment Act 1936 .

(2) The amount is so much of an amount equal to the section 4 0 - 285 amount as does not exceed the difference between:

(a) the asset's * cost; and

(b) the asset's * adjustable value, worked out under Division 40 as if that Division applied with the changes described in section 355 - 310.

355 - 447 Balancing adjustments for assets partially used for R&D activities

(1) The * R&D entity has an amount under this section if:

(a) a * balancing adjustment event happens in the present year for an asset * held by the R&D entity and for which:

(i) the R&D entity can deduct, for an income year, an amount under section 4 0 - 25, as that section applies apart from Division 355 and former section 73BC of the Income Tax Assessment Act 1936 ; or

(ii) the R&D entity could have deducted, for an income year, an amount as described in sub paragraph ( i) if the R&D entity had used the asset; and

(b) the R&D entity is entitled under section 355 - 100 to * tax offsets for one or more income years for deductions (the R&D deductions ) under section 355 - 305 for the asset; and

(c) an amount (the section 4 0 - 285 amount ) is included in the R&D entity's assessable income for the asset under section 4 0 - 285 (after applying subsection 4 0 - 292(2)) for the present year .

Note: This section applies in a modified way if you have deductions for the asset under former section 73BA or 73BH of the Income Tax Assessment Act 1936 (see section 4 0 - 292 of the Income Tax (Transitional Provisions) Act 1997 ).

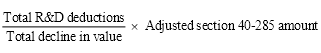

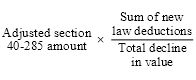

(2) The amount is worked out as follows:

where:

"adjusted" section 40-285 amount means so much of an amount equal to the section 4 0 - 285 amount as does not exceed the total decline in value.

"total decline in value" means the * cost of the asset less its * adjustable value.

355 - 448 Balancing adjustments for R&D partnership assets only used for R&D activities

(1) The * R&D entity (the partner ) has an amount under this section if:

(a) the partner is a partner in an * R&D partnership; and

(b) a * balancing adjustment event happens in the present year for an asset * held by the R&D partnership; and

(c) the R&D partnership cannot deduct, for the asset for an income year, an amount under section 4 0 - 25, as that section applies apart from:

(i) this Division; and

(ii) former section 73BC of the Income Tax Assessment Act 1936 ; and

(d) the partner is entitled under section 355 - 100 to * tax offsets for one or more income years for deductions under section 355 - 520 for the asset; and

(e) the partner is registered under section 27A of the Industry Research and Development Act 1986 for one or more * R&D activities for the present year; and

(f) an amount (the section 4 0 - 285 amount ) would, as mentioned in subsection 355 - 525(3), be included in the R&D partnership's assessable income for the present year for the asset and the balancing adjustment event.

Note 1: This section applies in a modified way if the partner has deductions for the asset under former section 73BA or 73BH of the Income Tax Assessment Act 1936 (see section 355 - 325 of the Income Tax (Transitional Provisions) Act 1997 ).

Note 2: Section 4 0 - 293 applies if the R&D partnership can deduct an amount under section 4 0 - 25, as that section applies apart from this Division and former section 73BC of the Income Tax Assessment Act 1936 .

(2) The amount is the partner's proportion of the amount that is so much of an amount equal to the section 4 0 - 285 amount as does not exceed the difference between:

(a) the asset's * cost; and

(b) the asset's * adjustable value, worked out under Division 40 as if that Division applied with the changes described in section 355 - 310.

355 - 449 Balancing adjustments for R&D partnership assets partially used for R&D activities

(1) The * R&D entity (the partner ) has an amount under this section if:

(a) the partner is a partner in an * R&D partnership; and

(b) a * balancing adjustment event happens in the present year for a * depreciating asset * held by the R&D partnership and for which:

(i) the R&D partnership can deduct, for an income year, an amount under section 4 0 - 25, as that section applies apart from Division 355 and former section 73BC of the Income Tax Assessment Act 1936 ; or

(ii) the R&D partnership could have deducted, for an income year, an amount as described in sub paragraph ( i) if it had used the asset; and

(c) one or more partners (including the partner) in the R&D partnership are entitled under section 355 - 100 to * tax offsets for one or more income years for deductions under section 355 - 520 for the asset; and

(d) an amount (the section 4 0 - 285 amount ) is included in the R&D partnership's assessable income for the asset under section 4 0 - 285 (after applying subsection 4 0 - 293(2)) for the present year.

(2) The amount is the partner's proportion of the amount worked out as follows:

where:

"adjusted" section 40-285 amount means so much of an amount equal to the section 4 0 - 285 amount as does not exceed the total decline in value.

"total decline in value" means the * cost of the asset less its * adjustable value.

"total R&D deductions" means the sum of each partner's deductions mentioned in paragraph ( 1)(c) of this section.

355 - 450 Amount to be included in assessable income

(1) The * R&D entity must include, in the entity's assessable income for the present year, the sum of the following amounts for each offset year relating to the clawback amount:

where:

"adjusted offset" means the * tax offset the R&D entity would have received under section 355 - 100 for the offset year if the total amount mentioned in subsection 355 - 100(1) for that tax offset were reduced by the portion of the clawback amount that is attributable to the offset year.

"deduction amount" means the portion of the clawback amount that is attributable to the offset year, multiplied by the R&D entity's * corporate tax rate for the offset year.

"starting offset" means the amount of the * tax offset the R&D entity has received, or is entitled to receive, under section 355 - 100 for the offset year.

(2) However, if this section, or section 355 - 475, has previously applied (whether in the present year or an earlier income year) in relation to another clawback amount, or catch up amount, the * R&D entity has that relates to the offset year, subsection (1) of this section applies as if:

(a) the starting offset were the * tax offset the R&D entity would have received under section 355 - 100 for the offset year if the total amount mentioned in subsection 355 - 100(1) were:

(i) decreased by the sum of the portions of any such other clawback amounts that are attributable to the offset year; and

(ii) increased by the sum of the portions of any such other catch up amounts that are attributable to the offset year; and

(b) the reference to the "total amount" in the definition of adjusted offset were a reference to that amount as so adjusted.

355 - 455 What this Subdivision is about

An R&D entity can deduct an amount under this Subdivision if:

(a) a balancing adjustment event happens for an asset held by the R&D entity (or an R&D partnership in which the R&D entity is a partner); and

(b) tax offsets have been obtained under this Division for deductions for the asset; and

(c) the R&D entity (or the R&D partnership) can otherwise deduct an amount for the asset and the balancing adjustment event.

Table of sections

Operative provisions

355 - 460 When this Subdivision applies

355 - 465 Assets only used for R&D activities

355 - 466 Assets partially used for R&D activities

355 - 467 R&D partnership assets only used for R&D activities

355 - 468 R&D partnership assets partially used for R&D activities

355 - 475 Amount that can be deducted

355 - 460 When this Subdivision applies

This Subdivision applies to an * R&D entity for an income year (the present year ) if:

(a) the R&D entity has an amount (a catch up amount ) under section 355 - 465, 355 - 466, 355 - 467 or 355 - 468 for an asset for the present year; and

(b) the R&D entity has received, or is entitled to receive, a * tax offset under section 355 - 100 for one or more income years (each an offset year ) in relation to the asset.

355 - 465 Assets only used for R&D activities

(1) The * R&D entity has an amount under this section if:

(a) a * balancing adjustment event happens in the present year for an asset * held by the R&D entity; and

(b) the R&D entity cannot deduct, for the asset for an income year, an amount under section 4 0 - 25 as that section applies apart from:

(i) this Division; and

(ii) former section 73BC of the Income Tax Assessment Act 1936 ; and

(c) the R&D entity is entitled under section 355 - 100 to * tax offsets for one or more income years for deductions under section 355 - 305 for the asset; and

(d) the R&D entity is registered under section 27A of the Industry Research and Development Act 1986 for one or more * R&D activities for the present year; and

(e) the R&D entity can deduct, for the present year, an amount under subsection 355 - 315(2) for the asset and the balancing adjustment event.

Note 1: This section applies in a modified way if the entity also has deductions for the asset under former section 73BA or 73BH of the Income Tax Assessment Act 1936 (see section 355 - 320 of the Income Tax (Transitional Provisions) Act 1997 ).

Note 2: Section 4 0 - 292 applies if the entity can deduct an amount under section 4 0 - 25, as that section applies apart from this Division and former section 73BC of the Income Tax Assessment Act 1936 .

(2) The amount is an amount equal to the amount mentioned in paragraph ( 1)(e).

355 - 466 Assets partially used for R&D activities

(1) The * R&D entity has an amount under this section if:

(a) a * balancing adjustment event happens in the present year for an asset * held by the R&D entity for which:

(i) the R&D entity can deduct, for an income year, an amount under section 4 0 - 25, as that section applies apart from Division 355 and former section 73BC of the Income Tax Assessment Act 1936 ; or

(ii) the R&D entity could have deducted, for an income year, an amount as described in sub paragraph ( i) if the R&D entity had used the asset; and

(b) the R&D entity is entitled under section 355 - 100 to * tax offsets for one or more income years for deductions (the R&D deductions ) under section 355 - 305 for the asset; and

(c) the R&D entity can deduct an amount (the section 4 0 - 285 amount ) for the asset under section 4 0 - 285 (after applying subsection 4 0 - 292(2)) for the present year.

Note: This section applies in a modified way if you have deductions for the asset under former section 73BA or 73BH of the Income Tax Assessment Act 1936 (see section 4 0 - 292 of the Income Tax (Transitional Provisions) Act 1997 ).

(2) The amount is worked out as follows:

where:

"total decline in value" means the * cost of the asset less its * adjustable value.

355 - 467 R&D partnership assets only used for R&D activities

(1) The * R&D entity (the partner ) has an amount under this section if:

(a) the partner is a partner in an * R&D partnership; and

(b) a * balancing adjustment event happens in the present year for an asset * held by the * R&D partnership; and

(c) the R&D partnership cannot deduct, for the asset for an income year, an amount under section 4 0 - 25, as that section applies apart from:

(i) this Division; and

(ii) former section 73BC of the Income Tax Assessment Act 1936 ; and

(d) the partner is entitled under section 355 - 100 to * tax offsets for one or more income years for deductions under section 355 - 520 for the asset; and

(e) the partner is registered under section 27A of the Industry Research and Development Act 1986 for one or more * R&D activities for the present year; and

(f) the partner can deduct an amount under subsection 355 - 525(2) for the present year for the asset and the balancing adjustment event.

(2) The amount is an amount equal to the amount mentioned in paragraph ( 1)(f).

355 - 468 R&D partnership assets partially used for R&D activities

(1) The * R&D entity (the partner ) has an amount under this section if:

(a) the partner is a partner in an * R&D partnership; and

(b) a * balancing adjustment event happens in the present year for a * depreciating asset * held by the R&D partnership and for which:

(i) the R&D partnership can deduct, for an income year, an amount under section 4 0 - 25, as that section applies apart from Division 355 and former section 73BC of the Income Tax Assessment Act 1936 ; or

(ii) the R&D partnership could have deducted, for an income year, an amount as described in sub paragraph ( i) if it had used the asset; and

(c) one or more partners (including the partner) in the R&D partnership are entitled under section 355 - 100 to * tax offsets for one or more income years for deductions under section 355 - 520 for the asset; and

(d) the R&D partnership can deduct an amount (the section 4 0 - 285 amount ) for the asset under section 4 0 - 285 (after applying subsection 4 0 - 293(2)) for the present year.

Note: This section applies in a modified way if the partners have deductions for the asset under former section 73BA or 73BH of the Income Tax Assessment Act 1936 (see section 4 0 - 293 of the Income Tax (Transitional Provisions) Act 1997 ).

(2) The amount is the partner's proportion of the amount worked out as follows:

where:

"total decline in value" means the * cost of the asset less its * adjustable value.

"total R&D deductions" means the sum of each partner's deductions mentioned in paragraph ( 1)(c) of this section.

355 - 475 Amount that can be deducted

(1) The * R&D entity can deduct, for the present year, the sum of the following amounts for each offset year relating to the catch up amount:

where:

"adjusted offset" means the * tax offset the R&D entity would have received under section 355 - 100 for the offset year if the total amount mentioned in subsection 355 - 100(1) for that tax offset were increased by the portion of the catch up amount that is attributable to the offset year.

"deduction amount" means the portion of the catch up amount that is attributable to the offset year, multiplied by the R&D entity's * corporate tax rate for the offset year.

"starting offset" means the amount of the * tax offset the R&D entity has received, or is entitled to receive, under section 355 - 100 for the offset year.

Note: A deduction under this subsection is not a notional deduction: see subsection 355 - 105(2).

(2) However, if this section, or section 355 - 450, has previously applied (whether in the present year or an earlier income year) in relation to another catch up amount, or clawback amount, the * R&D entity has that relates to the offset year, subsection (1) of this section applies as if:

(a) the starting offset were the * tax offset the R&D entity would have received under section 355 - 100 for the offset year if the total amount mentioned in subsection 355 - 100(1) were:

(i) increased by the sum of the portions of any such other catch up amounts that are attributable to the offset year; and

(ii) decreased by the sum of the portions of any such other clawback amounts that are attributable to the offset year; and

(b) the reference to the "total amount" in the definition of adjusted offset were a reference to that amount as so adjusted.

30 Subsection 355 - 525(2) (heading)

Repeal the heading.

31 At the end of subsection 355 - 525(2)

Add:

Note 1: A deduction under this subsection is not a notional deduction (see subsection 355 - 105(2)).

Note 2: A deduction under this subsection will result in a catch up amount for the partner (see section 355 - 467).

32 Subsections 355 - 525(3) to (7)

Repeal the subsections, substitute:

(3) If an amount would be included in the * R&D partnership's assessable income for the event year under subsection 4 0 - 285(1) for the asset and the event if Division 40 applied as described in paragraph ( 1)(e), the partner's proportion of that amount is included in the partner's assessable income for the event year.

Note: Some or all of the amount included in the partner's assessable income may result in a clawback amount for the partner (see section 355 - 448).

33 Section 355 - 530

Omit "For the purposes of sections 40 - 292 (balancing adjustments for decline in value) and", substitute "For the purposes of section".

34 Subsection 355 - 715(2)

Omit ", 355 - 315, 355 - 520 or 355 - 525", substitute "or 355 - 520".

35 Subsection 355 - 715(2) (note 2)

Repeal the note, substitute:

Note 2: Section 355 - 305 is about the decline in value of R&D assets and section 355 - 520 is about the decline in value of R&D partnership assets.

36 Section 355 - 720

Repeal the section.

37 Subsection 360 - 40(2)

Repeal the subsection, substitute:

(2) For the purposes of paragraph ( 1)(c), disregard any of the following:

(a) an Accelerating Commercialisation Grant under the program administered by the Commonwealth known as the Entrepreneurs' Programme;

(b) an amount required to be included in the company's assessable income under subsection 355 - 450(1).

38 Subsection 995 - 1(1) (definition of feedstock revenue )

Omit "section 355 - 470", substitute "subsection 355 - 445(4)".

Omit "sections 12A and 12B" (wherever occurring), substitute " section 1 2A".

40 Sections 12B and 31

Repeal the sections.

Income Tax (Transitional Provisions) Act 1997

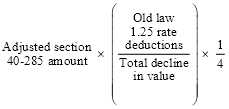

41 Sub section 4 0 - 292(3) (formula)

Repeal the formula (not including the definitions), substitute:

42 After subsection 4 0 - 292(3)

Insert:

Application of Division 355

(3A) In applying Division 355 of the new Act in relation to the asset for the income year, the R&D entity is taken to have:

(a) if the section 4 0 - 285 amount is an amount included in the R&D entity's assessable income--a clawback amount under section 355 - 447 of the new Act for the income year; or

(b) if the section 4 0 - 285 amount is a deduction--a catch up amount under section 355 - 466 of the new Act for the income year;

equal to the following amount:

where:

"adjusted" section 40-285 amount means:

(a) if the section 4 0 - 285 amount is a deduction--the amount of the deduction; or

(b) if the section 4 0 - 285 amount is an amount included in the R&D entity's assessable income--so much of the section 4 0 - 285 amount as does not exceed the total decline in value.

"total decline in value" means the cost of the asset less its adjustable value.

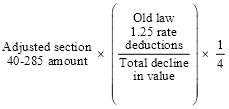

43 Sub section 4 0 - 293(3) (formula)

Repeal the formula (not including the definitions), substitute:

44 After subsection 4 0 - 293(3)

Insert:

Application of Division 355

(3A) In applying Division 355 of the new Act in relation to the asset for the income year, an R&D entity (the partner ) that is a partner in the R&D partnership and is entitled to one or more new law deductions for one or more income years for the asset, is taken to have:

(a) if the section 4 0 - 285 amount is an amount included in the R&D partnership's assessable income--a clawback amount under section 355 - 449 of the new Act for the income year; or

(b) if the section 4 0 - 285 amount is a deduction--a catch up amount under section 355 - 468 of the new Act for the income year;

equal to the partner's proportion of the following amount:

where:

"adjusted" section 40-285 amount means:

(a) if the section 4 0 - 285 amount is a deduction--the amount of the deduction; or

(b) if the section 4 0 - 285 amount is an amount included in the R&D partnership's assessable income--so much of the section 4 0 - 285 amount as does not exceed the total decline in value.

"sum of new law deductions" means the sum of each partner's new law deductions mentioned in paragraph ( 2)(b) of this section.

"total decline in value" means the cost of the asset less its adjustable value.

45 Subsection 355 - 320(1) (note 1)

Omit "(the new law deductions )".

46 Subsection 355 - 320(3) (heading)

Repeal the heading, substitute:

Deduction

47 Subsection 355 - 320(3) (note)

Repeal the note.

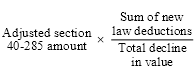

48 Subsection 355 - 320(4) (formula)

Repeal the formula (not including the definitions), substitute:

49 After subsection 355 - 320(4)

Insert:

Application of Division 355

(4A) In applying Division 355 of the new Act in relation to the asset for the income year, if the R&D entity is entitled under section 355 - 100 of the new Act to tax offsets for one or more income years for deductions (the new law deductions ) under section 355 - 305 for the asset, the R&D entity is taken to have

(a) if an amount is taken to be included in the R&D entity's assessable income for the event year as mentioned in subsection (4) of this section--a clawback amount under section 355 - 446 of the new Act for the income year equal to the amount mentioned in subsection (4B) of this section; or

(b) if the R&D entity is taken to be able to deduct an amount as mentioned in subsection (3) of this section--a catch up amount under section 355 - 465 of the new Act for the income year equal to the amount of that deduction.

(4B) The amount is the following:

where:

"adjusted" section 40-285 amount means so much of the section 4 0 - 285 amount as does not exceed the total decline in value.

"total decline in value" means the asset's cost, less its adjustable value, worked out under Division 40 of the new Act as it applies as described in subsection (2) of this section.

50 Subsection 355 - 325(1) (note 1)

Omit "(the new law deductions )".

51 Subsection 355 - 325(3) (heading)

Repeal the heading, substitute:

Deduction

52 Subsection 355 - 325(3) (note)

Repeal the note.

53 Subsection 355 - 325(4)

Repeal the formula (not including the definitions), substitute:

54 Subsections 355 - 325(4A) to (4D)

Repeal the subsections, substitute:

Application of Division 355

(4A) In applying Division 355 of the new Act in relation to the asset for the income year, if one or more partners (including the partner) in the R&D partnership is entitled under section 355 - 100 of the new Act to tax offsets for one or more income years for deductions under section 355 - 520 of that Act for the asset, the partner is taken to have:

(a) if an amount is taken to be included in the R&D entity's assessable income for the event year as mentioned in subsection (4) of this section--a clawback amount under section 355 - 448 of the new Act for the income year equal to the amount mentioned in subsection (4B) of this section; or

(b) if the partner is taken to be able to deduct an amount as mentioned in subsection (3) of this section--a catch up amount under section 355 - 467 of the new Act for the income year equal to the amount of that deduction.

(4B) The amount is an amount equal to the partner's proportion of the following:

where:

"adjusted" section 40-285 amount means so much of the section 4 0 - 285 amount as does not exceed the total decline in value.

"sum of new law deductions" means the sum of each partner's deductions under section 355 - 520 of the new Act mentioned in subsection (4A) of this section.

"total decline in value" means the asset's cost, less its adjustable value, worked out under Division 40 of the new Act as it applies as described in subsection (2) of this section.

55 Section 355 - 720

Repeal the section.

Part 3 -- Application of amendments

56 Application of amendments

(1) The amendments made by Part 1 of this Schedule apply on or after 1 July 2021 in connection with a scheme, whether or not the scheme was entered into, or was commenced to be carried out, before that day.

(2) Despite subitem (1), the amendments made by Part 1 of this Schedule do not apply in relation to tax benefits that a taxpayer derives before that day.

(3) The amendments made by Part 2 of this Schedule apply in relation to assessments for income years commencing on or after 1 July 2021.